I’ve got the POWER… Platform

Previous posts, (Part 1, Part 2 & Part 3) focused on how your business processes can benefit from a smart combination of SAP and Microsoft365. In this post, we take a step forward and look at a different part of the Microsoft portfolio, namely the Power Platform, and see how we can reshape SAP processes.

![]() Power Platform is a collective term for Microsoft’s low-code products used to build and deliver applications to analyze data, build solutions, automate processes, and create virtual agents. Three additional points worth noting:

Power Platform is a collective term for Microsoft’s low-code products used to build and deliver applications to analyze data, build solutions, automate processes, and create virtual agents. Three additional points worth noting:

- The platform is designed for business users, or those individuals Microsoft calls citizen developers who are close to the business need as opposed to developers or IT.

- Four specific products make up the platform: Power BI for analytics, Power Apps for building apps, Power Automate to create automated workflows, and Power Virtual Agents to develop AI-powered chatbots.

- Everything is integrated in the Microsoft ecosystem, especially Microsoft365, and can be combined with each other.

So, how can these tools help make the life of SAP users easier and reshape business processes?

The most obvious scenario is to use Power BI as an analytical frontend to analyze the data in your SAP systems. With user-friendly functionality and predictive analytics, Power BI can be easily integrated with the SAP system on the application or database layer (most likely SAP HANA). However, there are many tools out there covering these requirements, including SAP’s own Analytics Cloud offering, so we will focus on the automation capabilities and look at an interesting scenario from the insurance world.

We are all familiar with filing an insurance claim. In most cases, you can find a form on an insurer’s website and enter the required data. That’s a nice user experience for the policyholder, but what does the process look like for the insurer?

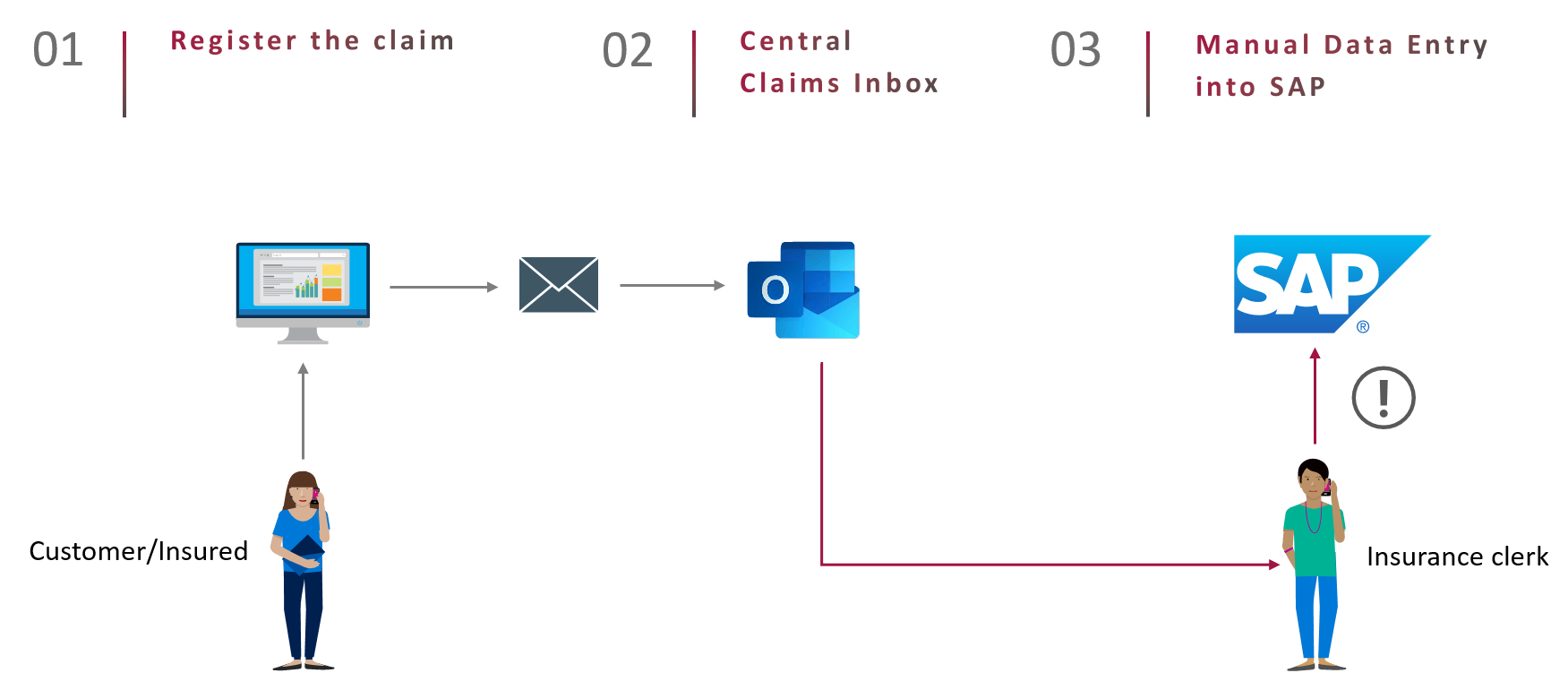

In many instances, the form data gets converted into an email sent to a specific inbox in the insurance company. Then a manual process starts: a clerk classifies the data and transfers it to the SAP system, attaches the email, and uploads pertinent attachments like photos of the damage. Then the claims processing in SAP can start. The process might look like this:

This typical process comes with some drawbacks:

- Manual data transfer always contains the risk of errors.

- Human intervention can create a bottleneck in the process.

As a result, the claim disbursement could be incorrect or delayed. The last thing a policyholder with a claim wants is to wait for their money, and any negative customer experience may cost the insurer a customer.

The Microsoft Power Platform can greatly improve data transfer to SAP by automating the workflow through Power Automate.

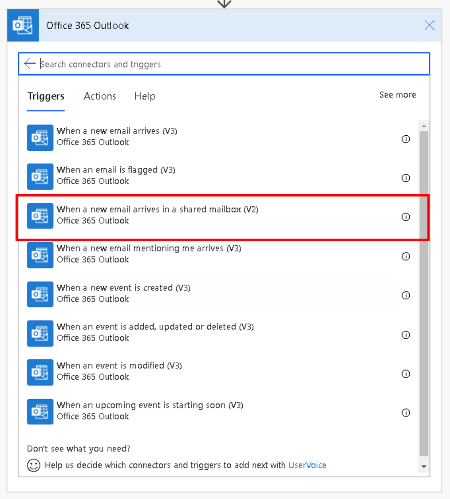

The claim email filed by the insured can serve as a trigger to initiate the workflow, and with the Power Platform and Microsoft365 integration, Power Automate comes with such a trigger out of the box.

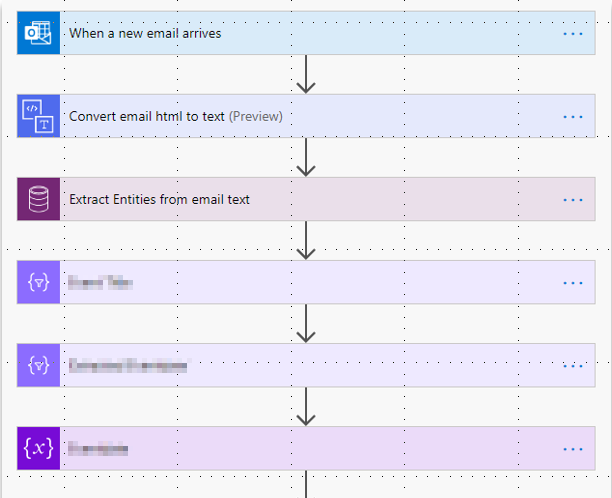

The AI Builder (within Power Platform) extracts data and attachments using form processing (for text) and object recognition (for images) without coding or data-science skills. It also extracts contract numbers and other required information from the email. The Power Automate workflow might look like this:

Different branches can be added to expand processing, depending on the line of business for which the claim is submitted. There’s considerable flexibility in designing the workflow logic and tailoring data preparation before importing to SAP to automate the process as much as possible. Manual intervention may be needed on occasion, which can be accommodated.

Lastly, to transfer the data to SAP, Power Automate contains SAP ERP Connectors that provide a low-code connection approach directly to SAP systems with well-established technologies like RFC and BAPI.

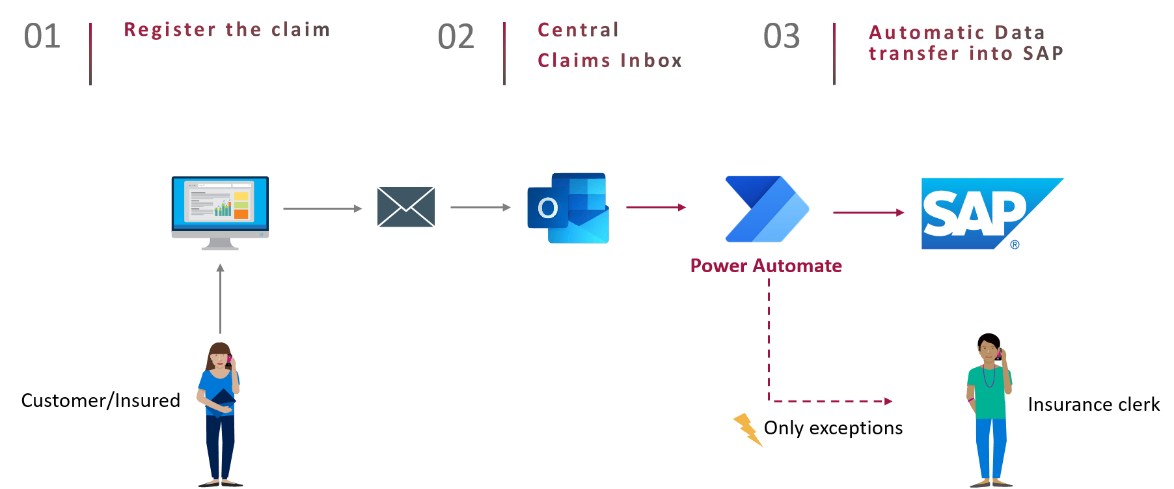

Finally, the new enhanced workflow looks like this:

What did we achieve? Starting from a quasi-automated process that required manual and error-prone tasks by default, we increased process automation via Power Automate and the AI Builder to fully automate data integration with SAP. Automation is good. Smart automation is better, since it also improves the customer experience by streamlining the flow. And it’s better still if it doesn’t require specialized IT development work.

This post wraps up our four-part series highlighting how the SAP and Microsoft partnership creates exciting opportunities for increased automation, efficiency, and collaboration. We will continue to share new use cases, so please follow us on LinkedIn and look for future posts.