Accelerate Your Tax Reporting

BEPS 2.0 Pillar 2 and Beyond

Ditch the

Spreadsheet

Technology is the only way to efficiently manage BEPS 2.0 Pillar 2 reporting. With SAP Profitability and Performance Management, we have created a configurable framework to centralize data, calculate tax obligations, and analyze data drivers. Let us show you the right tools to automate and navigate regulatory adoption.

Solution

Benefits

Technology is the key to simplifying complex reporting standards. Our solution utilizes native S/4HANA processing for speed and workflow processes to enable complete, auditable reporting. Built-in configurable framework is based on up-to-date BEPS 2.0 Pillar 2 reporting standards to speed implementation and allow for rapid visibility of the tax reporting for enhanced decision-making.

Get Up and Running

Our Services

Don't go it alone. Embarking on any solution implementation can be overwhelming. But, with an experienced partner by your side, you can mitigate risk and learn the software from the most knowledgeable SAP Profitability and Performance Management partner in the world.

Data Assessment

Assess Source System Complexities, Data Consolidation Level, and Pinpoint Data Provisioning Requirements

Impact Analysis

Pillar II Simulations for One Fiscal Year, Review Results, and Analyze for Internal Decision-making

Implementation Service

Seamless Integration, Data Consolidation, Comprehensive Pillar II Calculations, and Reporting

Tax Solution Maintenance Service

Technical and Functional Maintenance for New Regulations, Countries, and Tailored to Customer Needs

Our 3-in-1

Solution

One stop for all your BEPS 2.0 Pillar 2 needs. Centralize all relevant data in one place and automate data sourcing. Leverage predefined content for calculations and reporting. Manage global tax reporting requirements, compliance, and regulatory disclosures based on a holistic view across all company levels.

Integrate.

Streamline Integration with SAP and non-SAP Sources Systems

- Easy data import from different sources and solutions

- Gain more efficiency with automated data uploads and updates

- Manage a high quantity of data on different levels across the company

- Improve data quality

Calculate.

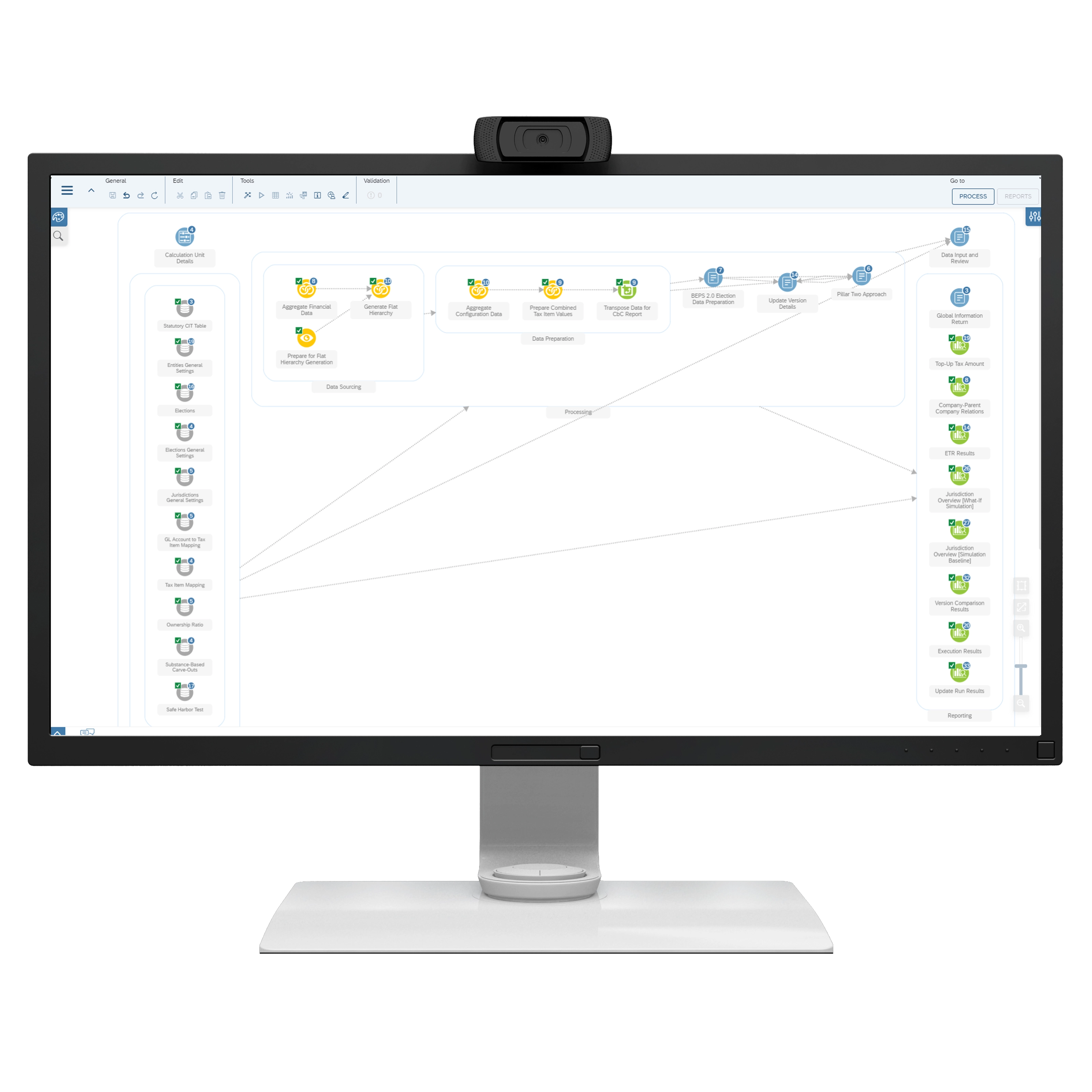

Calculation Engine & Process-workflow

- Elevate efficiency by using BEPS 2.0 Pillar 2 configurable framework

- Business-user interface to keep management and control with the users

- Full Traceability, built-in auditability

- Programmable calculation rules engine & workflow management

Report.

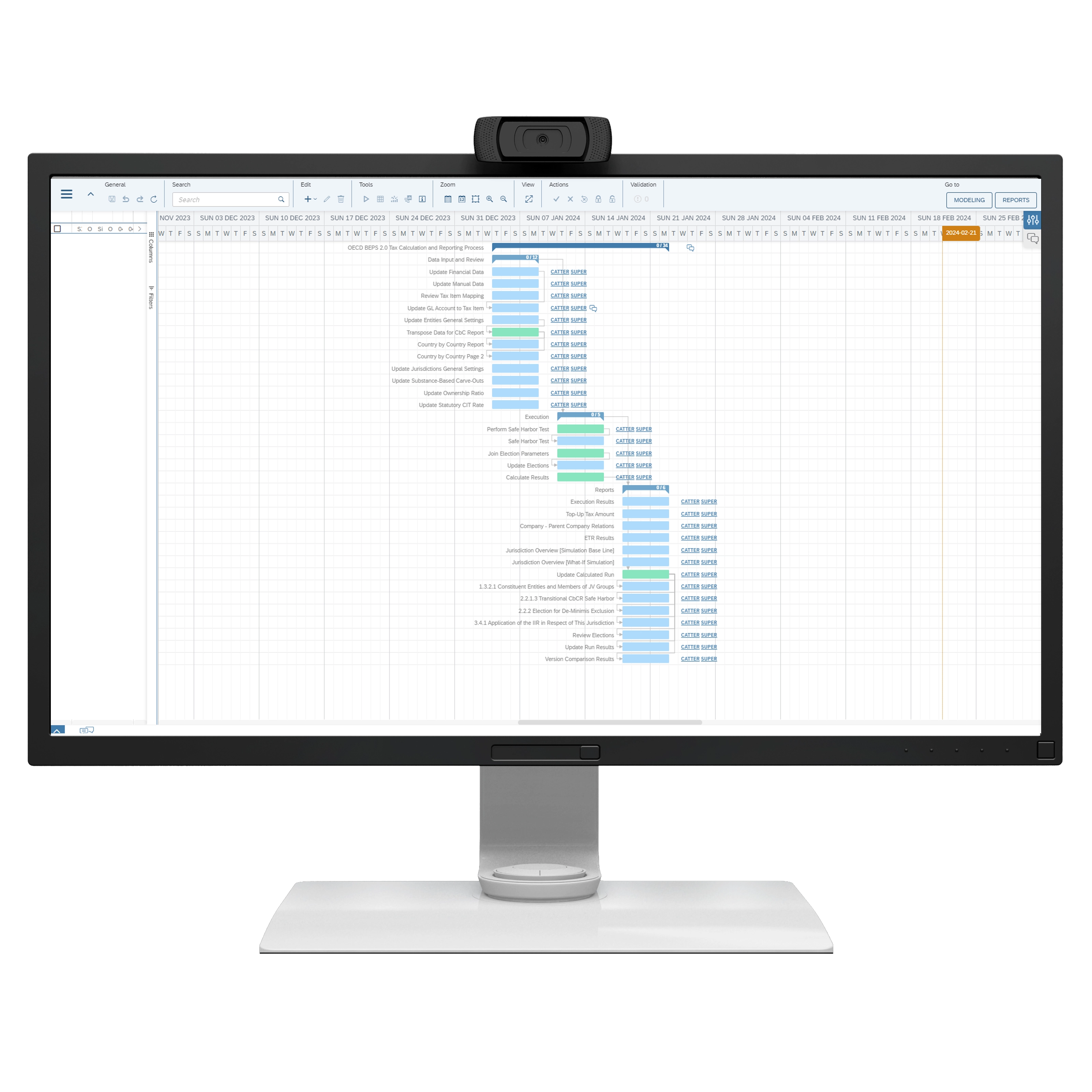

Planning, Analysis, and Reporting

- Built-in reporting and dashboards for BEPS 2.0 Pillar 2

- Plan, forecast, and simulate to improve tax liability

- Identify risks and opportunities to create short-term, mid-term, and long-term plans

- Set and analyze country-by-country reporting

What customers say

Performance

We are committed to intelligent IT and industry solutions — from consulting and development to implementation. Our services help companies maximize the opportunities of digitalization to improve operational efficiency and decision-making capabilities.

An Introduction to Base-Erosion and Profit Shifting BEPS 2.0

As the global economy becomes more digital, the tax environment becomes even more complicated.