Whether you have one accounting standard or fifty, the Baseline Delta Approach could be the key to a more efficient close process.

After talking with many customers and partners regarding implementation plans (and wishes) for SAP S/4HANA Financial Products Subledger (FPSL), one of the most common questions is whether to use the Baseline Delta Approach (BDA) or not. What I commonly hear, to put it bluntly, is the question: “isn’t the Baseline-Delta Approach overkill if we ‘only’ want to implement IFRS 17?”

Wouldn’t it be nice if a system could answer that question!. But let’s be honest, a system is, after all, just a piece of software that can help resolve a business problem. It will process and produce results according to a predefined schema, and it will follow the same process regardless of whether we are talking about one accounting standard or fifty.

Let’s break it down.

First, how does SAP FPSL view the Baseline Delta Approach from a pure software perspective? For those who have already had some exposure to the solution, the fact that there is a standard accounting process model will not be a surprise. For those who know SAP from the general ledger perspective, this is probably also no surprise - we know SAP leads the way when it comes to accounting software competence.

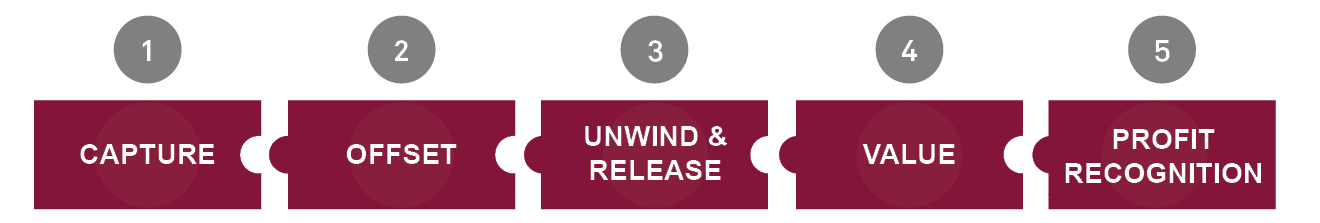

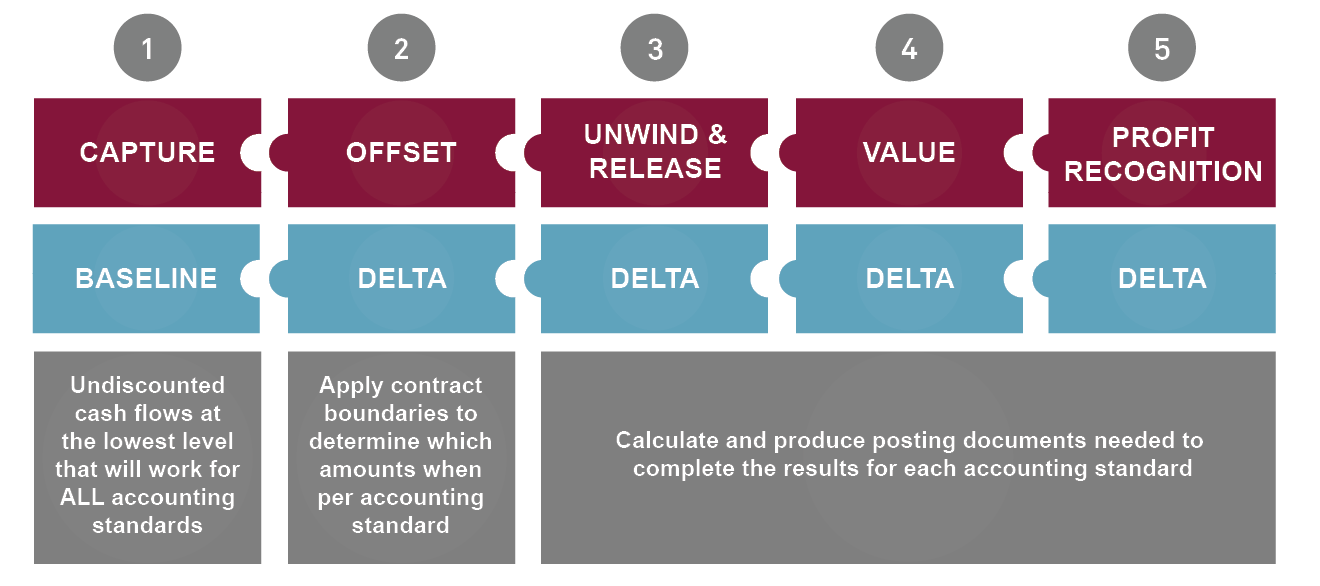

In the context of insurance subledger accounting, the process model is broken down into these steps:

1. CAPTURE. Post undiscounted cash flows.

2. OFFSET. If some cash flows aren‘t (yet) relevant for a certain GAAP, remove them.

3. UNWIND AND RELEASE. Discounting and interest accretion tasks using locked in rates.

4. VALUE. Calculate margins where required such as default risk, prudence adjustments or revaluation at current interest rates.

5. PROFIT RECOGNITION. Perform operations that are driven by some kind of earning pattern.

As I said earlier, you can run this process for one accounting standard or fifty, and the process steps are the same. If you have multiple accounting steps, some of the details will be different - for example, you would use yield curve A for IFRS 17 and yield curve B for US GAAP, possibly in conjunction with a risk free yield curve if you want all details. Or you would calculate a CSM for IFRS 17 GMM but earn a premium using a pattern for another standard. Or even use the same concept to differentiate between local and group results.

Now let‘s map this idea to the BDA. It‘s simple: the baseline is nothing other than the undiscounted cash flows that we have posted in the first step (CAPTURE). The deltas are nothing other than the GAAP specific adjustments we post after that (OFFSET, UNWIND & RELEASE, VALUE, and PROFIT RECOGNITION). So far, so good, right? So it doesn‘t matter which cash flows you start with from a system perspective, as long as the combination of cash flows and deltas leads to correct and complete results. From a system perspective, a very simple process.

But wait there’s more.

The real complexity comes from the business problem. If I have a strategic vision to perform multi-GAAP accounting using SAP FPSL, then I need to make sure that I have all the information required, and make sure that the information is delivered only once and re-used for all GAAPs. If I can do that, I am well on my way to automating a huge number of calculations and significantly reducing reconciliation efforts.

In this context, I have four major things to consider from a business perspective:

- How do I define my best estimate cash flow?

- How do I define contract boundary conditions, in other words, when do the amounts become valid for each accounting standard?

- Which amounts are relevant (in scope) for each standard?

- How do I ensure that the amounts are provided at a level of granularity, so that different grouping criteria for different accounting standards are met?

In my opinion, the BDA from a system perspective is simple and that same system approach will be used whether we are talking about one GAAP or many.

The real question is the business one. Do I want to perform concurrent valuations over multiple accounting standards with the target to have a truly efficient accounting process or not? If the answer is yes, I need to think about how I can deliver my data in such a way that complete re-use is possible over all the accounting standards, and this could well have an organizational or system impact in other areas.

So what do you think? Could your organization and your close process benefit from the Baseline Delta Approach? If you would like more information, please feel free to contact me at the email address below.

For more information on SAP S/4HANA Financial Products Subledger, please go to our website here.