Full Speed IFRS17 Implementations with Eco Delivery

IFRS17 is one of the biggest accounting and financial reporting changes in decades, impacting every facet of an insurance company’s landscape. The bad news is there is not much time left to get up and running. The good news is this can bring innovation and new ideas. The better news is we can help, and we don’t need much time.

When push comes to shove, the actuaries and the accountants are the people that make IFRS17 happen. The problem is that regular work doesn’t stop, limiting their ability to focus on the changes necessary to implement the new regulations. With any implementation, the three main challenges are budget, time, and complexity. And with IFRS17, these are even more complex.

With SAP’s Financial Product Subledger (FPSL) and our Eco Delivery services, we can help you quickly understand the system and data requirements needed to get compliant in six months or less — not the one to three years it might otherwise take. Here’s how we do it.

Hands-on Experience & Knowledge

We’ve refined Eco Delivery during engagements with more than 17+ major insurance companies worldwide. The beauty of FPSL is it performs all the necessary IFRS17 calculations because the logic is built-in. That’s great, but how do you get comfortable with the built-in calculations and be fully prepared for your IFRS17 implementation? That is where we can help. We can talk you through it, hold your hand (figuratively, of course), and guide the system set up, process workflows, testing, and a smooth business user hand-over.

Benefit #1. Been there. Done that.

Beginning with a scoping workshop, we’ll work with you to identify the requirements appropriate to your circumstances. We’ll help you figure out how to integrate your source systems (claims, policy premiums, and actuarial projection), post the results in the general ledger, and produce IFRS17 disclosures. We’ll help you run all the necessary calculation testing and review the final results.

Accountants & Actuaries Working Together

In most insurance organizations, accountants and actuaries live on two separate planets. But IFRS17 is almost like a mandated cooperation treaty. And to get the job done, it demands extensive cross-functional cooperation.

Benefit #2: So let’s work together.

We don’t look at IFRS17 as an obligation. We look at it as an opportunity to connect accounting, finance, and actuaries. With Eco-delivery, you can take advantage of the msg global best-practice IFRS17 use cases developed from real project experience and market best practices. Our team is ready to enable your team and help you work together to cover the critical IFRS17 requirements with minimal implementation effort. We can provide a complete solution overview, answer your questions, and deliver the experience we have gained from our previous implementations.

Follow the Leader

The biggest part of any journey is planning the trip. Our implementation project plan is a clear start to finish your roadmap with business documents, test cases, and data configuration guidance.

Benefit #3: A road MORE traveled.

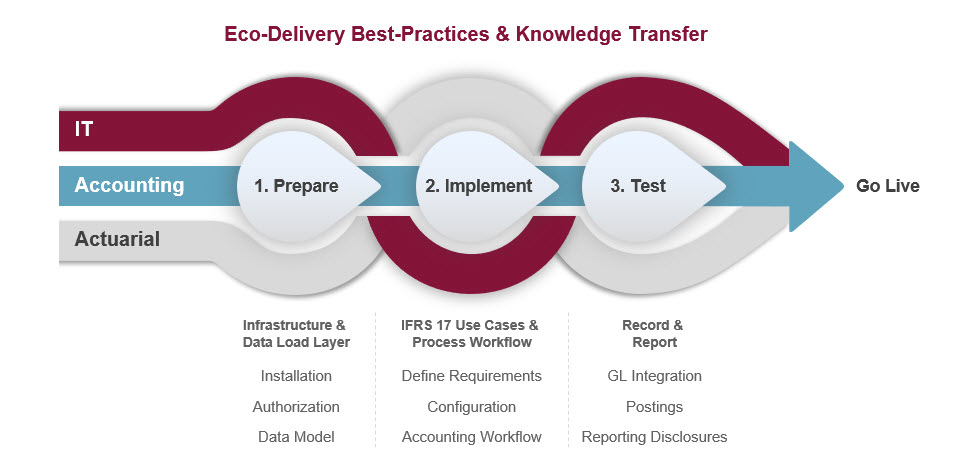

Prepare. Implement. Test. Go Live. Sounds simple, but the key is coordination between all the players based on best practices and effective knowledge transfer. We deliver a highly focused and efficient implementation. If you can make the right people available, we can help them learn the system, define the requirements, establish the accounting workflow, and produce the reporting disclosures.

Save Time … and Money

Our Eco Delivery team wants to shave months off your implementation timeline. Experience matters, and the easiest way to save time and money is to talk to people that know insurance, know the mechanics of an IFRS17 implementation, and know first-hand how to deploy the SAP financial subledger. Now that you know about msg global, let us know how we can support you.

For more information about Eco Delivery click here.