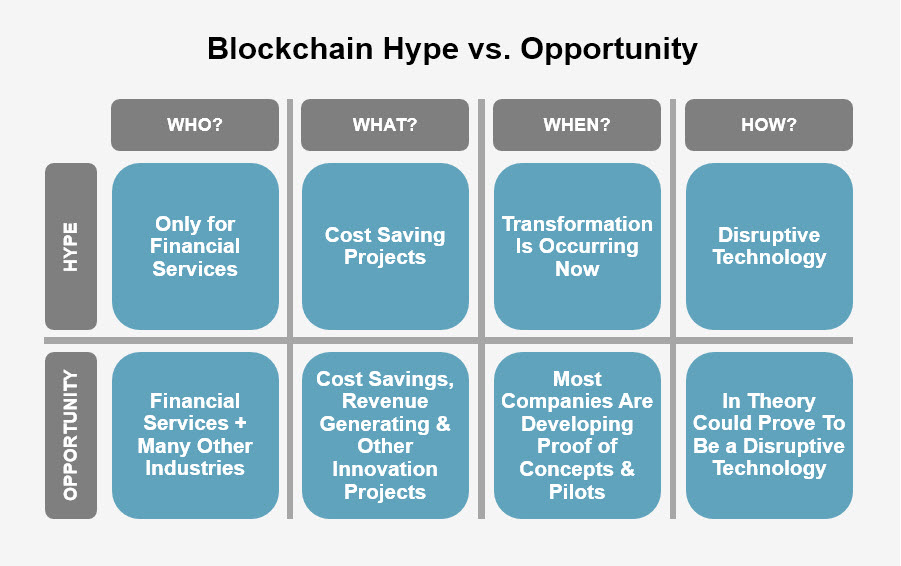

Let’s move beyond Blockchain HYPE and find the real OPPORTUNITIES.

Since there’s so much confusion and disinformation about blockchain, let’s start at the beginning. According to the website Blockgeeks:

The blockchain is an incorruptible digital ledger of economic transactions that can be programmed to record not just financial transactions but virtually everything of value … Information held on a blockchain exists as a shared — and continually reconciled — database … The blockchain database isn’t stored in any single location, meaning the records it keeps are truly public and easily verifiable.

Presuming that's true (there’s no reason to suspect it’s not), blockchain has the potential to be the new digital processing transactional player for the insurance industry, enabling transactions to flow, effortlessly and securely, through multiple organizational layers in organizations of every stripe, from the origins of those transactions all the way to the utopia of the Capital Markets. Cue the heavenly choir.

Not So Fast

Albert Einstein said, “In theory, theory and practice are the same. In practice, they’re different.” He was right. And blockchain’s theoretical ability to transform the insurance industry is hitting a few snags in practice. Here’s one of the reasons why. Blockgeeks also describes blockchain as:

Transparent and incorruptible … [living] in a state of consensus, one that automatically checks in with itself every ten minutes … altering any unit of information on the blockchain would mean using a huge amount of computing power to override the entire network … It cannot be corrupted.

To that, the insurance industry adds the word “yet.”

And while blockchain is a hot topic in fintech and insurtech — conventional wisdom held that 2017 would be The Year of the Blockchain — the insurance industry has three other obstacles to overcome:

- Its historically consistent languor in adopting technology

- Its historically consistent languor in shedding legacy systems

- Its historically phobic (but somewhat justifiable) reluctance to expose its data

Don’t Go Away

Make no mistake: Blockchain can help address some key challenges facing insurers in a digital age, including the needs to understand and meet customer needs more fully, and to cut costs by making operations more efficient. But, as everything else in and around the insurance industry, the adoption of blockchain will take some time, some trust, and some proving.

But it’s not going away. Neither should you.