Digital customer engagement for the financial services industry

The Financial Services Accelerator (FSA) is a tailor-made omni-channel solution for insurers and other financial service providers such as retail banks. The FSA empowers financial institutions to accelerate their digital transformation and compete in the omni-channel world. It provides a streamlined, continuous and personalized customer experience while meeting the unique needs of the insurance and financial services industry.

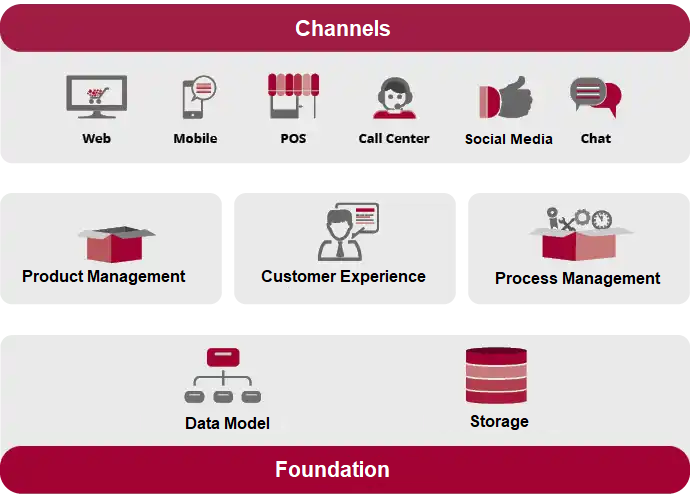

Three Pillars

The Three Pillars are essential to provide a consistent omni-channel journey. Product management brings agility to customer offerings that are independent of the main product houses. The customer experience offers flexible and refined customization. Industry-relevant processes allow for fast time to market. The pillars lie at the top of the proven financial services data model and the base of the SAP Commerce Cloud platform for all industries.

Benefits

![]()

Quotation and New Business Process

![]()

Product Packages

![]()

Content management system

Flexible and customizable quotation and new business process with predefined integration points for policy classification and administration mechanisms.

Flexible and intuitive assembly of Product Packages for cross-selling physical goods or services with insurance products and banking services.

Ccollection of insurance-specific Web Content Management System (WCMS) components (e.g., product comparison, location agent, my policies) enabled for SmartEdit.

![]()

Self-service area

![]()

Configurable Forms

![]()

Management of personal data and consent

Self-service area for specific insurance clients to view and resume quotes created, consult policies, as well as view claims and premiums. Bank-specific customer self-service area to view and resume applications and account queries.

Integration with a friendly editor for product-specific or general forms that support validation rules, as well as interdependent and dynamic fields.

Support for General Data Protection Regulation (GDPR) with consent management, as well as personal data loss, change recording and reporting.

Benefits

![]()

Quotation and New Business Process

Flexible and customizable quotation and new business process with predefined integration points for policy classification and administration mechanisms.

![]()

Product Packages

Flexible and intuitive assembly of Product Packages for cross-selling physical goods or services with insurance products and banking services.

![]()

Content management system

Ccollection of insurance-specific Web Content Management System (WCMS) components (e.g., product comparison, location agent, my policies) enabled for SmartEdit.

![]()

Self-service area

Self-service area for specific insurance clients to view and resume quotes created, consult policies, as well as view claims and premiums. Bank-specific customer self-service area to view and resume applications and account queries.

![]()

Configurable Forms

Integration with a friendly editor for product-specific or general forms that support validation rules, as well as interdependent and dynamic fields.

![]()

Management of personal data and consent

Support for General Data Protection Regulation (GDPR) with consent management, as well as personal data loss, change recording and reporting.

Need more information?

Contact us and we'll work with you to help you understand all your options and select the solutions that best meet your needs so that your business works the way you want.