World's leading software

for Reinsurance

Digitize

Reinsurance Management

Stop the spreadsheet madness and digitize reinsurance operations with a comprehensive end-to-end reinsurance solution. Offered in the cloud or on-premise, SAP S/4HANA Insurance for reinsurance management supports premiums, loss reserves, commission calculation, claims processing, and reporting for life and non-life ceded and assumed contracts.

A Visual Overview of

Reinsurance Management

Learn how SAP S/4HANA Insurance for reinsurance management covers the complete reinsurance life cycle and how a strong implementation partner like msg global can add to your success with an innovative reinsurance software solution.

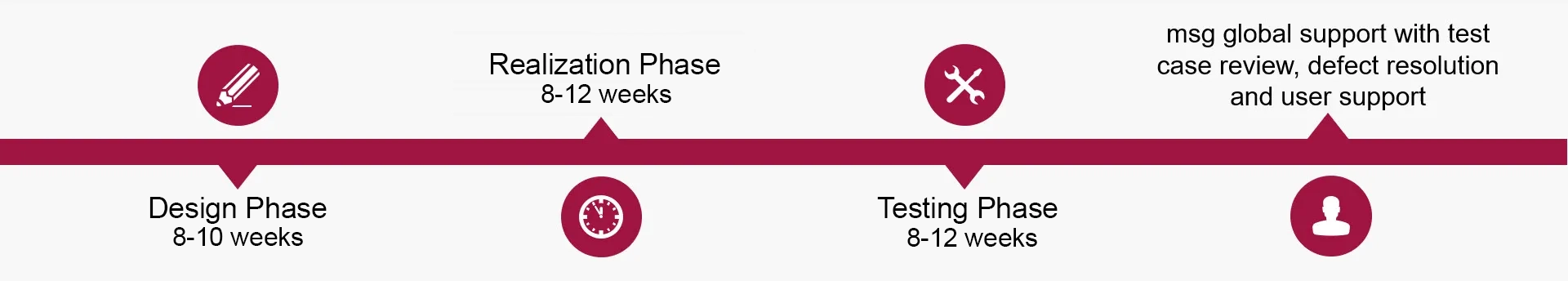

Rapid Design

to Delivery

Our accelerated implementation approach allows for smooth design and delivery in just months, including the setup of SAP Business Partner, SAP Reinsurance solution, SAP Collection and Disbursement, out of the box integration to the SAP General Ledger, and with the option to include Schedule F or additional ad-hoc reporting using modern SAP HANA-based technologies.

Experts

for Reinsurance

We are a knowledgeable partner for all reinsurance companies. With strategic consulting, established standard software, and other intelligent IT solutions, we help you with information management and networking, customer-centric customization, and the standardization and digitization of your processes.

Strategic Consulting

Map The Best Transformation Approach for Rapid Innovation

Finance Transformation

Shift to a Continuous Digital Transformation Model

Business Process Management

Optimize Overall Business Operations with Process Automation

Maintenance & Support

Technical & Functional Project Consulting Support and AMS

Digital Transformation

Solutions Developed to Accelerate Different Project Phases

Migration Consulting

Landscape Setup System Installation & Basic Support

End-to-End Processing

Proven Best Practice Solutions for E2E Implementations

Project Management

Proven Methodologies to Manage and Execute Implementations

How can we help?

Contact us today

We’ll help you understand the options and prioritize the steps that will give you the greatest returns in the least amount of time.